Security Reminder: Ivy Bank will never call, email, or text to ask for your passwords, PINs, or account details. We will never send links requesting your login or credentials, or ask you to change your phone settings. If you receive a suspicious message, don’t respond—contact us directly through our official, secure channels.

Backed by a bank with over 192 years of experience.

Backed by the strength and stability of Cambridge Savings Bank, a trusted financial institution based in the greater Boston area, Ivy Bank was created with the goal of helping to improve your financial well-being by offering user-friendly higher-interest rate products, exceptional digital experiences, and personalized service.

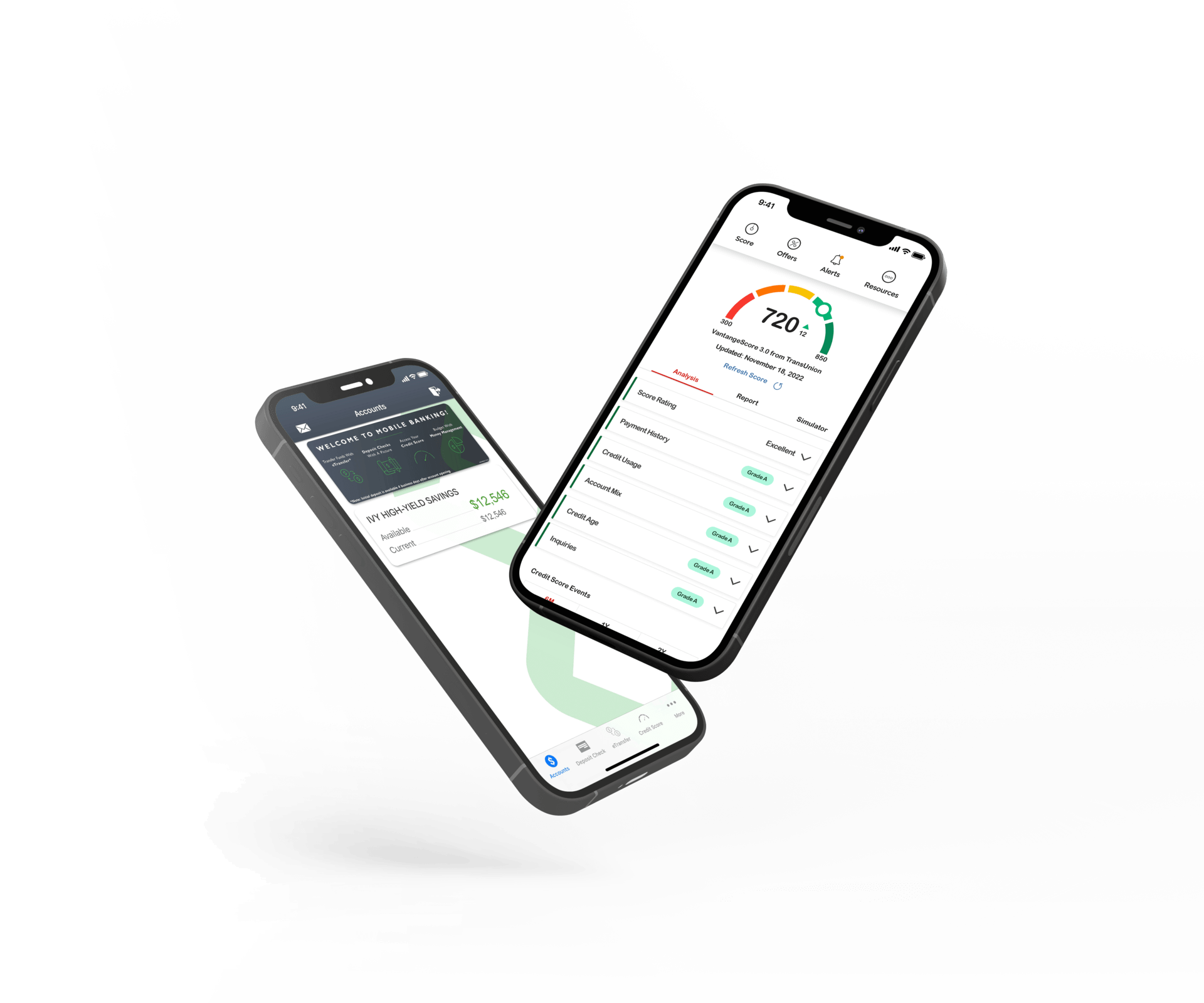

Access your Ivy Bank accounts on-the-go with our mobile banking app.

Why You'll Love Banking With Us

Apply for an

account in minutes

Opening an account

online is easy.

Mobile and

online

Convenient features that help you bank from your device.

No unexpected

charges

You won’t be thrown off by a charge you weren't expecting.

Great rates

Competitive market rates that help your money grow.

Pick The Savings Option That Helps Meet Your Needs

High-Yield Savings Account

- $2,500 minimum opening balance

- $2,500 minimum balance to earn rate and APY

- FDIC Insured

1 Year Certificate of Deposit

- Guaranteed returns for the length of the term

- $1,000 minimum opening balance

- FDIC Insured

1Rates effective as of 2/18/26. Minimum opening deposit of $2,500. The minimum balance to obtain the 3.85% Annual Percentage Yield (APY) is $2,500. If your balance is between $10 - $2,499.99, the interest rate is 0.05% and the APY is 0.05%. The maximum account balance to receive the 3.85% APY is $1,000,000. This is a tiered variable rate account, and rates may change after the account is opened. Fees may reduce earnings.

2FDIC Insured up to the maximum amount allowed by law. Ivy Bank and Cambridge Savings Bank are treated as the same entity for the purposes of calculating FDIC insurance limits.

3Transfers and withdrawals from Ivy Bank Savings accounts may be limited to a total of six per calendar month. Withdrawals and transfers shall only be made payable to one or more of the owners of the account.

4Rates effective as of 2/18/26 and are subject to change without notice. Minimum opening deposit of $1,000. The Annual Percentage Yield (APY) is based on monthly compounding with funds held to maturity. $10 minimum daily balance required to earn APY. Additional deposits are not permitted. Substantial penalties for early withdrawal may be imposed. Fees may reduce earnings. For more information, please refer to our disclosures.